Fight Back & Defend Your Rights Against Car Dealerships Auto Manufacturers Lying Salesmen Repair Shops

Pay Us Nothing Unless We Win Your Auto Fraud Case.

Vehicle History

Vehicle Condition

Warranties & Financing

Auto, Motorcycle, Truck and RV Dealer Fraud & Scams

Buying a car is not on our list of things we like to do, but the process comes around every few years to make us feel uneasy at best, and sometimes distrustful at worst. After all, negative publicity about the shady practices of some car dealers gives us a healthy dose of skepticism every time we walk into a showroom.

Of course, most new and used car dealers ethically conduct business. As we have heard before, it is just a few rotten apples that spoil the batch. As a consumer purchasing a car, truck, motorcycle, or RV in California, you should know the types of scams some car dealers try to pull, as well as what you need to do if you fall victim to auto fraud.

Certified Car Dealer Fraud Cases

According to California consumer protection law, a car, truck, motorcycle, or RV dealership cannot promote a used car, as certified if one or more of the following conditions exist:

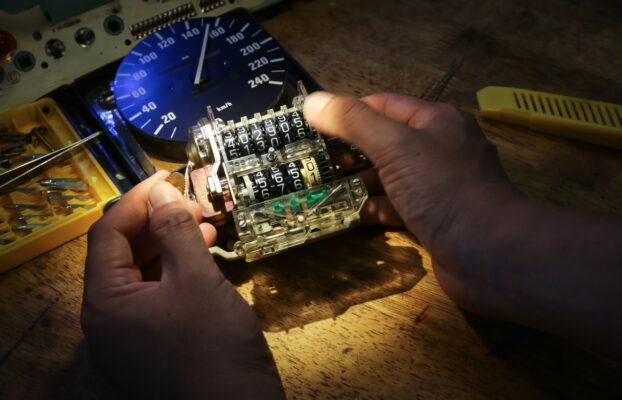

- The Dealer lied about the odometer reading and it does not reflect an accurate number of miles.

- The car dealer knew about the rollback of an odometer or the replacement of an old odometer with a brand new odometer.

- The car dealership should have known about the manufacturer (GM, Ford, Tesla, Hyundai etc.)taking back a car due to a state or federal warranty law.

- The car, motorcycle, truck or RV’s title has the word “junk, flood, salvage, manufacturer repurchase, or lemon law buyback” inscribed clearly.

- Damage to the car caused by fire, flood, or impact diminishes the safety of a vehicle.

- The Dealer knew about damage to the frame of a car.

- The Dealer refused to honor any warranties.

- Dealership failed to deliver a state-approved inspection report before closing a sale.

California Car Laws that Protect You

Although not as historically significant as the Bill of Rights to the United States Constitution, the California Car Buyer’s Bill of Rights packs a powerful legal punch. Licensed car dealerships must provide prospective buyers with a detailed itemized list for each financial component that makes up the total price of a car, truck, motorcycle, or RV for sale. Car dealers must also present each customer’s credit score and explain how the business plans to use the score in determining creditworthiness.

The California Car Buyer’s Bill of Rights places a financing fee cap on car loans. Anytime a car dealer offers a certified new or used car for sale, it must present a customer with a copy of the inspection report that verifies the vehicle is certified. A limit placed on contract cancellation fees, as well as restocking fees, ensures car dealers do not attempt to price gouge car buyers.

California is considered the leader on a large number of social, political, and economic initiatives. On the economic front, one of the most influential consumer protection laws in the country is called the California Consumer Legal Remedies Act (CLRA). The landmark California law not only lists numerous fraudulent business practices, but also gives consumers legal remedies to get justice.

The unlawful practices mentioned in the CLRA describe generic “goods and services.” However, the CLRA clearly has legal relevance for auto dealerships that engage in fraudulent business practices. Under the CLRA, businesses are prohibited from implementing the following practices:

- Lying about the source of goods or services

- Claiming goods are new when in fact they have deteriorated in condition

- Denigrating the quality of the goods and services offered by another business

- Making false statements regarding the reason(s) for a price reduction of a good or service

- Claiming a good or service is needed, when in fact it is not

- Misleading consumers into thinking a sales agent or representative has the authority to close deals

- Adding an unreasonable provision into a sales contract

- Stating a good or service is one thing when it is quite another thing

The last prohibited practice applies especially to car dealerships that claim the auto repair shop used manufacturer parts when the shop used aftermarket parts.

According to the CLRA, legal remedies for consumers that fall victim to fraudulent business practice, include restitution, actual damages, punitive damages, and an order issued by a judge that prevents a dealership from implementing future fraudulent business practices.

The California Business and Professions Code addresses issues that consumers bring up regarding dealer auto fraud. However, most consumers do not know what protections the California Business and Professions Code grants them.

Auto dealerships must post a notice in a high-traffic area of a dealership that states there is not a no-cancellation policy for leased and purchased vehicles. Consumers have the right to cancel a contract for cause, such as in the case of fraudulent activities. Auto dealerships also must offer a two-day cancellation option for some pre-owned car sales that have a purchase price under $40,000.

Without understanding the provisions written into the California Business and Professions Code, many consumers might notice a no-cancellation policy and believe they have to follow the policy.

Types of Car Dealer Fraud

Auto dealerships that engage in fraud typically take advantage of the trust customers develop during the sales process. Consumers should know that auto fraud can happen at any point, from the first time you come across the car of your dreams to the day you sign the sales contract.

Here are the most common types of auto dealer fraud:

5 FAQs for New & Used Car Dealer Fraud

California consumer protection attorneys hear a long list of questions that concern auto fraud. Here are the answers to five common questions:

Read What Our Clients Have to Say....

I reached out to John to help me with an issue I had with a dealership on my new vehicle purchase. John is extremely knowledgeable, helped answer all my questions, and worked diligently to get my issue resolved. He is great with follow up and put my best interest first. Most importantly, I did not feel any pressure working with John. I highly recommend John's services if you are looking for a lawyer that is professional and fair.

Annonymous

Learn More About Auto, Motorcycle, and RV Fraud...

We love sharing our knowledge to help educate others.

Work with a California Auto Fraud Lawyer

Filing a civil lawsuit against a car dealer that committed auto fraud might lead to winning monetary damages. In addition to actual damages, you might be able to force the dealer to pay for legal costs and pay you restitution for some or all of the cost of the vehicle.

California law allows plaintiffs in auto fraud cases to receive punitive damages, which is money set aside to punish car dealers for violating one or more of California’s Consumer Protection laws. Also referred to as exemplary damages, a judge orders punitive damages to deter a car dealer from committing future fraudulent acts.

In California, fraud means “intentional misrepresentation, deceit, or concealment of a material fact known to the defendant with the intention on the part of the defendant of thereby depriving a person of property or legal rights or otherwise causing injury.”

If you think that you are a victim of auto fraud, you should contact a California-licensed Consumer Protection lawyer who has a record of winning auto fraud cases.

Your lawyer can help you organize the paperwork you need to submit during a civil lawsuit, as well as provide you with advice on how to proceed with your auto fraud case. Consumer protection lawyers can also negotiate settlements that prevent a case from reaching the litigation stage.